By Anisha Sircar

(Reuters) – European shares on Wednesday were little changed amid persisting recession fears, with investors eyeing growth and inflation data due this week for clues about the region’s economic health and the monetary policy outlook.

The pan-European STOXX 600 hovered near 10-week highs in a choppy trading session. Food and beverage stocks gained 1.0% to scale near three-week peaks, while real estate shed 1.1%.

Overnight, results from retailers Walmart and Home Depot bolstered views on the health of U.S. consumers, lifting Wall Street stocks ahead of July retail sales data due from the world’s largest economy. [.N]

The focus on Wednesday was also on the final euro zone flash GDP estimates for the second quarter due at 0900 GMT. While preliminary data showed faster-than-expected growth, economists fear it might be the economy’s last hurrah.

“European markets have taken a cue from Wall Street and Asia amid hopes the U.S. might avoid a recession due to consumer resilience, but gains are limited with investors treading water ahead of the Q2 revision, keen to see whether the more buoyant 0.7% growth reading will be maintained,” said Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown.

UK’s FTSE 100 was flat. British consumer price inflation rose to 10.1% in July, its highest since February 1982.

“Another 50 bps hike from the Bank of England next month is now more likely… Tightening is taking place against an already downbeat backdrop of negative growth expected from Q4 onwards, which is not a bright outlook for stocks,” said Stuart Cole, chief macro economist at Equiti Capital.

“The market is seeing the UK experience as a harbinger of what is to come in the EU.”

Among stocks, Uniper fell 7.2% after the German utility reported a first-half net loss of 12.3 billion euros ($12.5 billion), mainly due to lower Russian gas supplies.

“Uniper’s big loss highlights the heavy cost the invasion of Ukraine has had on the German energy market. Projections that it should exit the loss zone in 2024 limited losses in early trade,” Streeter said.

Switzerland’s biggest life insurer Swiss Life rose 1.2% after posting a 4% rise in its half-yearly net profit.

European bourses have bounced off of June lows, mirroring sentiment on Wall Street as signs that U.S. inflation may have peaked lowered bets of aggressive rate hikes.

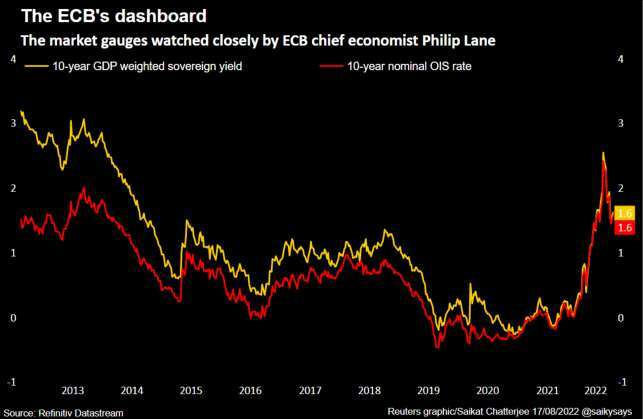

Money markets in the euro zone, meanwhile, continue to fully price in a 50 bps European Central Bank rate hike in September. [IRPR]

Graphic: Euro GDP weighted https://fingfx.thomsonreuters.com/gfx/mkt/zgpomgyrbpd/Euro%20GDP%20weighted.PNG

(Reporting by Anisha Sircar in Bengaluru; editing by Uttaresh.V)